Toyota, Chinese carmakers with biggest leap in innovation ranking

Every year the Innovation Ranking of the Center of Automotive Management (CAM) evaluates the innovative strength of the global automotive industry in a comprehensive survey. The study takes into account more than 1,200 automotive innovations of the year 2017/2018 from a total of 36 automobile groups with 89 automobile brands

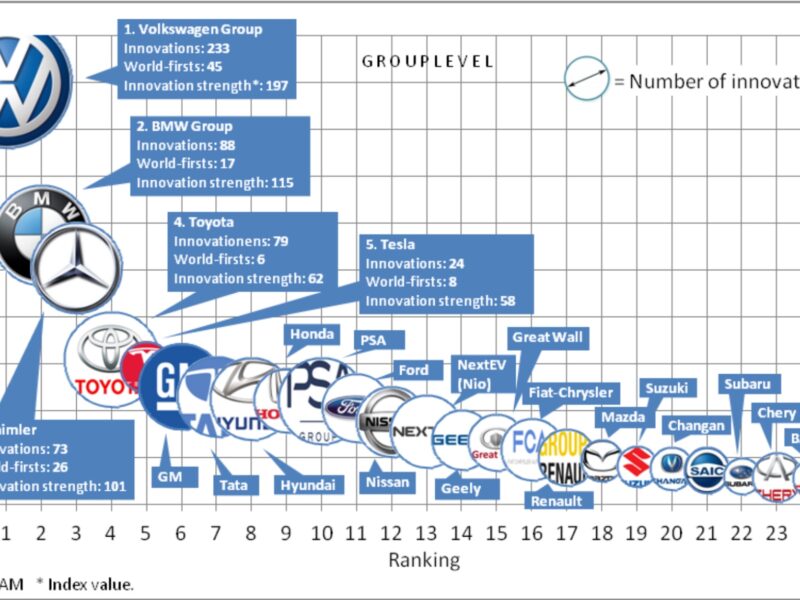

Despite the diesel scandal and WLTP crisis: Volkswagen is currently not only the world’s best-selling car manufacturer, but with its brands Audi, Porsche, VW & Co. also the most innovative carmaker. With 233 innovations, 45 of which are world firsts, the Wolfsburg-based company is ahead of the other German car manufacturers BMW and Daimler, who are switching places. Toyota and Tesla follow in fourth and fifth place (see image).

automotive industry took place in the middle and rear positions;

in the front everything – still – remained quiet. (C): CAM

About 50 percent of the high innovative strength of Germany’s top three groups is fed by the future fields of connectivity and Advanced Driver Assistance Systems (ADAS). By contrast, innovations from the combustion engine are contributing less and less to innovative strength (Volkswagen 11%, BMW 12%, Daimler 13%). The share of innovations in the area of pure electric vehicles (Volkswagen 3%, BMW 3%, Daimler 1%) is still comparatively low, although this will change in the coming years due to current product developments.

Stefan Bratzel, head of the study, comments: “Despite the diesel scandal and threats posed by new players, German automobile manufacturers are the innovation leaders in important fields of the future. In the field of electromobility, however, they are more likely to be “fast followers” and have to catch up quickly.”

The biggest rising star of the year is the Japanese Toyota Group. The company improved by eleven ranks over the previous year and now ranks fourth. This puts Toyota even one place ahead of last year’s third Tesla. Toyota’s luxury brand Lexus in particular is providing a series of highly rated innovations with the new edition of the LS model, including a semi-autonomous highway pilot or an avoidance assistant that can recognize pedestrians. With a share of 51 percent of innovations in the future-prone fields of connectivity and ADAS, Toyota corrects deficits of the past. Eight percent of Toyota’s innovative strength, however, still goes into the combustion engine.

Tesla cannot quite maintain its strong position in the innovation ranking of previous years and still comes in a very good fifth place with 24 innovations, including 8 world firsts. What is striking is the strong focus of innovations on the future fields of connectivity, ADAS and pure e-mobility, which make up 86 percent of Tesla’s total innovative strength.

The Indian Tata Group, with its British brands Jaguar and Land Rover, is also significantly more innovative this year. Currently in seventh place, Tata improved by six ranks compared to the previous year. The Land Rover brand contributes 54 percent and Jaguar 40 percent to the total number of 46 index points. The Tata brand itself – mainly active on the Indian market – plays hardly any role here.

In addition to Tesla, Hyundai and Fiat-Chrysler in particular are less innovative this year. After a strong performance in recent years, Tesla lost two places and finished fifth, Hyundai lost three places and is now only tenth. FCA slips back to position 14 (previous year: 8) after a “positive outlier” in the previous year. This is due to the dramatic drop in the number of innovations. While 77 individual innovations could still be reported in the previous year, it was less than half in the current period under review with 35 vehicle technology innovations.

What is striking is the ever better performance of Chinese manufacturers. Eight Chinese companies will be among the top 25 groups in 2018. With NextEV (brand “Nio”), the best is already in 13th place, ahead of traditional manufacturers such as Fiat-Chrysler, Renault or Mazda. However, like Byton, NextEV did not yet have any series-produced vehicles on offer during the investigation period, unlike the other Chinese OEMs in the ranking. Among the top 20 automotive companies are currently four OEMs of Chinese origin, only two years ago Geely (Volvo) was only one.

From a technical point of view, Chinese manufacturers are focusing primarily on the future fields of alternative drives and networking/autonomous driving. In the field of electric mobility (BEV, Battery Electric Vehicles), many series applications can already be recorded here, in the field of (autonomous

Related articles:

Carmakers lead German industry in R&D spending

Cobalt shortages will drive price for electromobility, experts say

Fuel cell development: Who’s in, who’s out

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News