The Criticality of the Automotive E/E Architecture

Modern vehicles commonly are described as “computers-on-wheels” due to the recent explosion of computing power and electronic features manufacturers are equipping in their vehicles. The world’s first automobiles, however, were relatively simple, and entirely mechanically operated. The first automotive electrical components were not even available until the 1930s, when manufacturers began offering vacuum tube radios.

Over time, vehicles have become dramatically more complex due to technological advances and consumer trends. Mechanical systems accounted for most of this complexity for much of the car’s history, but electrical and electronic systems have steadily increased in sophistication. Today, a majority of vehicle features are aided or enabled by electronic components and the underlying electrical and electronic (E/E) architecture. Engine management, braking, steering, infotainment, and other comfort and convenience features rely on the electrical and electronic systems. Embedded software has also come to play a dominant role in vehicle functionality. Modern cars contain millions of lines of code that make up applications for everything from the most advanced infotainment and passive safety features to the automatic door locks.

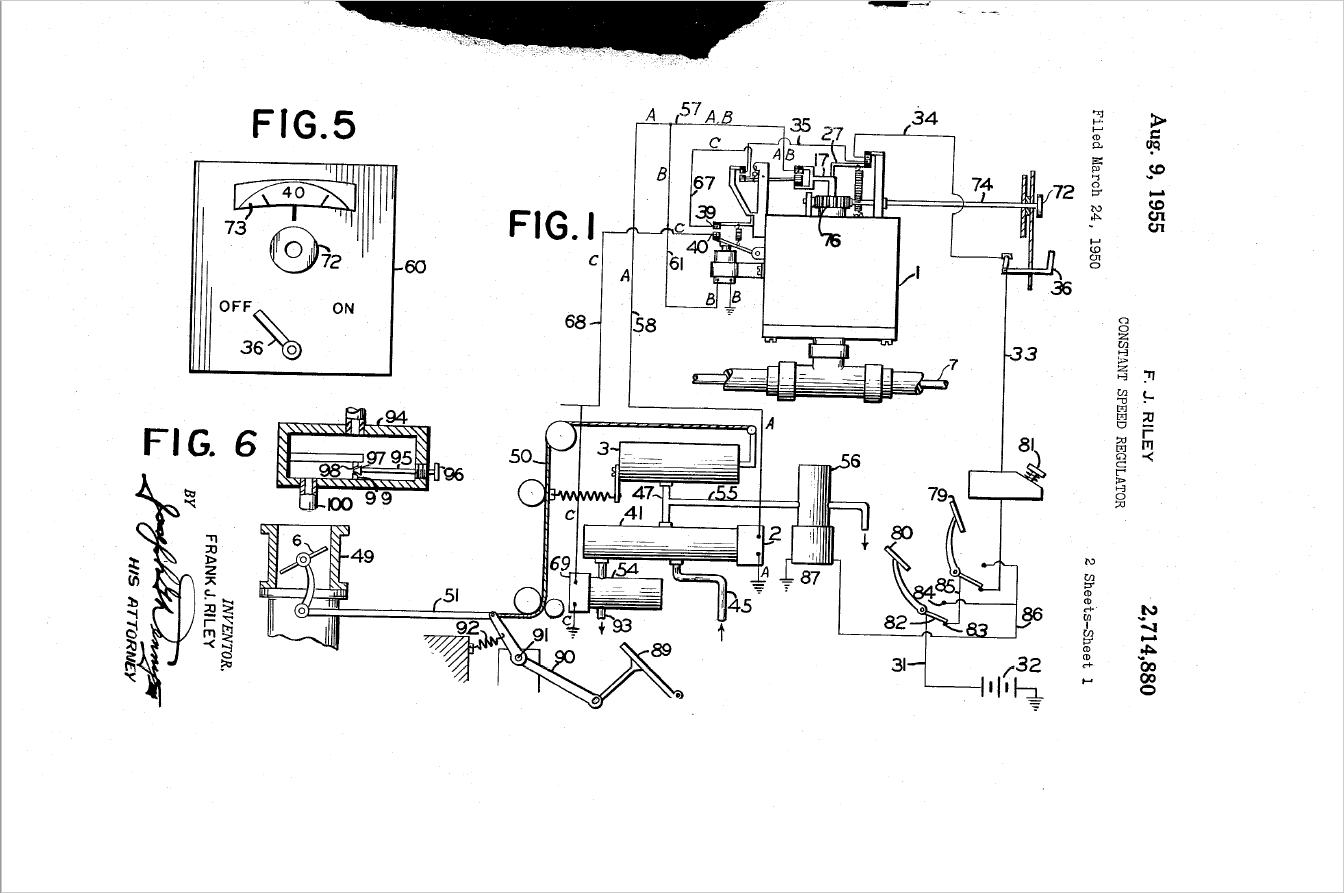

As vehicle features continue to evolve and grow in sophistication, previously unrelated subsystems will come into contact. Systems that previously evolved independently will begin to integrate, and depend on each other to achieve new functionalities. The introduction of cruise control in the late 1950s was the first integration of electrical and mechanical systems in a vehicle (Figure 1a). Since then, cruise control has continued to evolve. Adaptive cruise control systems allow modern cars to slow down and speed up as needed to maintain a driver-determined following distance (Figure 1b). And, automated emergency braking systems can bring vehicles to a complete stop even if the driver is not paying attention.

The result of this innovation and integration is a tremendously complex system of electronic control units (ECUs), sensors, actuators, and wiring to connect it all together. The size and complexity of these architectures create new challenges for automotive OEMs and their suppliers. These challenges will only become more intense as companies continue to advance vehicle technologies, particularly in the automated driving space. In this environment, the importance of the underlying E/E architecture is paramount.

Despite the challenges, automotive companies are investing in advancing their E/E architectures because they are becoming an enabler of new business models and new revenue streams. Wiring harness suppliers are expanding their offerings to cover design through manufacturing of vehicle wiring harnesses. Likewise, systems integration suppliers are providing a complete service for the implementation of vehicle subsystems developed from a combination of constraints and requirements defined by the OEM.

Meanwhile, OEMs are also making large investments to bring key areas of development, such as software, in-house. Volkswagen recently announced a new software development group that will create basic uniform software functions across the company’s brands, and eventually consist of five-thousand software experts and engineers (Automotive News, 2019). With their own software teams, OEMs can improve the ownership experience with routine software updates to improve system performance and fix latent issues. The OEM may also offer entirely new functionalities that customers can purchase, thus extending the life or increasing the performance and value of their vehicle.

Amidst large-scale technological change, established OEMs must innovate and differentiate via the E/E architecture. This means creating architectures that are scalable across vehicle platforms, flexible to future technologies, and reliable over extended lives in the field. It also means beating competitors to market with an attractive and advanced vehicle platform (Figure 2). To innovate at the pace required by today’s market; however, OEMs need to evolve their design processes to integrate across domains, automate design tasks, and provide robust data coherency.

Roadblocks

Automotive manufacturers and suppliers will face several challenges as they adapt to new consumer demands and advancing technologies.

Consumers want increased freedom to customize their vehicles through optional features without paying a premium price. OEMs are attempting to provide this customization on a mass scale, as their business still relies on making and selling large volumes of vehicles. At the same time, OEMs try to re-use bill-of-materials (BOM) across vehicle platforms to reduce costs in design and manufacturing, which is contradictory to customization. Thus, the greater number of potential vehicle configurations that exist, the more expensive it becomes to manufacture each car. It also becomes more challenging to track and coordinate architectural components, such as the correct version of ECU or software build, as well as corresponding connectors and terminals across the vehicle platform, enabling functional connectivity between devices.

Many, if not most, of the features consumers want are electronic in nature: infotainment, ADAS, and even air conditioning interface with an ECU running embedded software. With a greater number of more sophisticated electronics, the typical automotive supplier pipeline is much broader and deeper than before. Longer and larger supplier pipelines can greatly increase the time required to cascade and implement design changes. Ensuring that all teams understand the change being implemented and its effects on their domain is already a key challenge. Contracting with additional suppliers and expanding the supplier ecosystem to provide desirable features only compounds this problem.

Reducing the change implementation cycle enables OEMs to bring new vehicles to market more quickly, a key competitive advantage for companies operating in a very contentious market. Some manufacturers are attempting to shorten development cycles by bringing domains in-house that have been largely supplier-based. General Motors added almost ten-thousand information technology employees in a massive effort to bring IT services back under their control after years of outsourcing (Automotive News, 2017).

Next, the average new car today contains between 70-100 ECUs. In future vehicles, OEMs will consolidate these into fewer more powerful control units. How far this consolidation should go; however, is a point of major debate. Some advocate for a centralized architecture with a few, or a singular, very powerful ECU(s) managing vehicle functions. Others consider a distributed architecture with a greater number of ECUs a better option, primarily to create redundancy in vehicle systems.

OEMs may also investigate component consolidation as a cost-saving strategy. By fusing sensors, actuators, and other components together, OEMs can achieve the same functionality for reduced cost. On the other hand, OEMs may want to maintain independent components to preserve system redundancy.

Moreover, OEMs will look to limit investments to save on cost, but increasing architectural complexity and more stringent safety requirements increase the challenge of vehicle design. This increased challenge equates to greater cost, as investment is necessary to deliver the sophisticated vehicles demanded by the market.

Removing Roadblocks

The road forward for automotive OEMs and their suppliers remains lengthy and confusing. While full vehicle autonomy is a popular topic, highly impactful technologies will reach maturity long before true self-driving is achieved. These new technologies will further increase the demands for capability and reliability from the E/E architecture.

The E/E architecture is a convergence of domains: electronics hardware, network communications, software applications, and wiring all combine to make up the vehicle architecture. Currently, these domains operate with only limited knowledge of the activities, constraints, and goals of the other domains. This can cause significant problems where these domains interact. For example, several teams within an OEM may be developing software applications for the core ADAS ECU in the vehicle. These teams are organized by feature and work independently. For instance, there will be separate teams for the lane departure, active cruise control, and other applications. In order to ensure flexibility for future updates, a constraint caps the processor utilization for this ECU at around 75%. When each of the teams loads their software onto the ECU, they exceed the utilization cap and even the capabilities of the processor. This happened because each of the teams developed their implementations independently and had no ability to understand the totality of the load on the ECU until it was beyond a critical point in the development process.

Automotive manufacturers and suppliers will need to adopt a new design methodology to handle the interactions between these domains in an environment that is rapidly becoming more complicated. Several major automakers have undertaken major reorganizations to better align with these needs: Ford, Fiat-Chrysler, Daimler, among others. This methodology must ensure tight cross-domain integrations, powerful design automation, and comprehensive data coherency. Such a methodology provides each domain with a system-level context to leverage during domain-specific engineering. With a system-level context, engineers can evaluate design alternatives, root out issues, and achieve higher quality designs in less time.

However, industry challenges are not confined to technology innovation. As a result, the strategy for dealing with the immense and varied challenges of the mobility industry must extend beyond new design solutions. Major OEMs and suppliers alike are realizing that changes to their organizations and business models will lay the foundation for future success. OEMs are investing in increasing their software competency while long-time automotive suppliers are expanding the services they offer to cover the full range of component development, from design through manufacturing. In fact, some suppliers have even demonstrated autonomous shuttle and package delivery platforms. In general, the real challenge comes from scaling and creating profit from a new technology once it has been validated.

The continued expansion of the automotive E/E architecture has made its design more challenging and more critical in the scope of vehicle engineering. All aspects of the E/E architecture occupy a larger role in enabling core vehicle functionalities. As a result, all aspects, from devices like sensors and ECUs to the networks and wiring, have grown in sophistication to meet these increased demands. ECUs have become more powerful to process the data coming in from larger sensor arrays using increasingly capable software. Meanwhile, vehicle networks have to manage the communications in this intricate system of sensors and controllers.

The companies that adapt both their design methodologies and organizational structures to provide the highest quality electrical, electronic, and digital automotive experiences will enjoy the most success in a changing industry.

References

Labuhn, P. I. & Chundrlik Jr., W. J. (1995). U. S. Patent No. 5,454,442. Washington, DC: U.S. Patent and Trademark Office.

Riley, F. J. (1955). U. S. Patent No. 2,714,880. Washington, DC: U.S. Patent and Trademark Office.

About the author:

Doug Burcicki is the automotive director of the Integrated Electrical Systems Division of Mentor, A Siemens Business, responsible for strategy, execution and thought leadership. Prior to joining Mentor in early 2018, Burcicki was vice president of Yazaki North America, where he held several management roles during his 24 years of service. He holds a Master’s Degree in Automotive Engineering from Lawrence Tech University and a BSEE from Wayne State University.

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News