Study quantifies value of data from the connected car

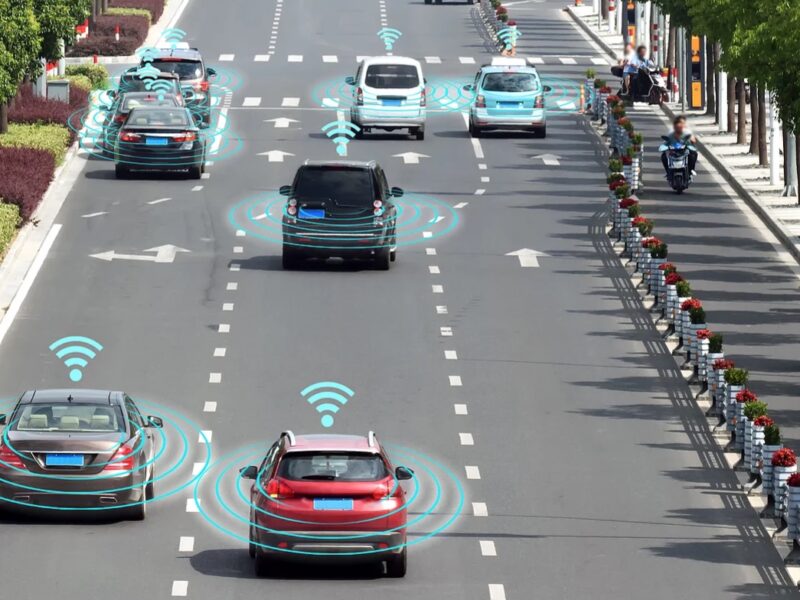

In less than ten years, 95 percent of all cars sold will be online. The use of data from the car has great economic potential: per vehicle, mobility companies in the entire ecosystem can realise an average of up to $310 in additional revenue and $180 in potential savings annually in 2030, the consulting firm McKinsey has calculated. This potential can be tapped both through services such as software updates for the car and through cost reductions, for example through a better range of models based on real usage data. According to the McKinsey experts, the total value potential amounts to up to 400 billion dollars. The entire mobility ecosystem is involved, from car manufacturers, suppliers and service providers to insurers, infrastructure and tech companies. This is the result of a recent study by McKinsey & Company. For the analysis, 38 fields of application for vehicle data were examined.

“Seven of the ten most valuable companies in the world base their success on data-based business models,” says Timo Möller, partner at the McKinsey Center for Future Mobility and co-author of the study. “In the mobility industry, however, the potential to make money with data is still too often untapped. Yet the monetisation of data is becoming increasingly important in view of declining profits from the classic car business. New entrants and companies outside the automotive sector are increasingly defining the standards by which customers also measure the car industry.”

Despite the great potential, data from cars has not yet been used on a large scale. According to McKinsey, there are three main reasons for this: The still unawakened customer interest, a lack of a powerful organisational unit in the companies and a limited ecosystem for driving data so far.

However, the automotive industry has now understood that connectivity solutions not only bring additional sales and cost savings over the entire life cycle of the car, but can also bind the customer much more strongly to the brand, says Möller “If you do it right”. If OEMs miss this business opportunity, there is huge potential here for new entrants and technology companies – so the industry must react.

Customer interest is fundamentally there: 37% of car buyers in a global McKinsey survey say they would switch brands for better connectivity – among premium brand customers, the figure is as high as 47%.

McKinsey expects 95% of all new vehicles in 2030 to have at least basic connectivity features – including reading vehicle data and integrating smartphones into the vehicle’s infotainment system. Today, the share of such vehicles is still at 50%. Around half of new vehicles will include even more advanced functions in 2030. This ranges from personalisation of content for each individual passenger to a virtual chauffeur making suggestions based on artificial intelligence.

“The higher the level of connectivity, the greater the potential for revenue and savings,” says Tobias Schneiderbauer, co-author of the analysis and Associate Partner at McKinsey. Basic car connectivity results in $130 to $210 in potential sales and $100 to $170 in potential savings. Advanced technologies, on the other hand, are already $400 to $610 in potential sales and $120 to $210 in potential savings. “This will be an important growth area, especially for premium manufacturers.”

According to the study, three applications are particularly important for the industry, accounting for around 40-45% of the total potential:

- Over-the-air updates: New features for the car are not only interesting for the customer, but also for manufacturers and increasingly for suppliers. They can generate additional revenue over the life cycle by activating features and new services, avoid expensive recalls in case of malfunctions and increase residual values of used vehicles. 39% of all customers are interested in the possibility to add additional services after purchase.

- Optimisation of hardware in research and development: On the basis of vehicle data, manufacturers and suppliers could develop new models more precisely – and, for example, design components that the customer hardly uses differently in the next vehicle generation. It can also be used to optimise the number of equipment variants.

- Predictive maintenance: Monitoring critical vehicle components can help to replace them before they fail completely, thus providing customers with an optimised customer experience. In addition, dealers and workshops can use this data to better manage their inventory, increase their utilisation and improve customer service.

More information: https://www.mckinsey.com/features/mckinsey-center-for-future-mobility/overview

Related articles:

eBook explores how connectivity transforms driving experience

NXP, AWS create cloud platform for vehicle data services

Connected car market forecast sees over 14% CAGR to 2027

Study: Value share of electronics in the car increasing rapidly

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News