“Solving tomorrow’s challenges will be easier with Qualcomm”

According to a statement in Siever’s keynote speech at the FTF Connects meeting, autonomous driving, full connectivity and electrification are expected to triple the value of the semiconductor content in cars. This added value is driven by functions like battery management and smart energy. But sensors, sensor data processing, sensor fusion and the downstream data handling are also a large opportunity for NXP.

Currently, the car industry is developing the set of capabilities required for automated valet parking and highway driving, but as soon as urban driving enters the game, the technological challenge will grow by an order of magnitude. Given the computing platforms thrown at the autonomous driving market, the question arises if NXP can offer sufficient computing power with its BlueBox platform.

“More focus on sensing than on processing”

For Lars Reger, this is not so much the question. The quality of the sensors is more important than the raw computing power, he believes. Nevertheless, for applications currently under development across the automotive industry like automated valet parking, BlueBox offers enough computing horsepower. As the industry will move up the autonomous driving ladder, NXP will also roll out more powerful platforms, Reger said. Furthermore, he expects new technological contributions to automated driving platforms from NXPs future parent company Qualcomm. “High-performance systems will be a main asset Qualcomm will contribute to the marriage. This applies not only to the silicon level, but also to the software tools,” Reger said.

Kurt Sievers added that NXPs current platform is “completely sufficient for all of today’s ADAS systems and for the ADAS systems that will reach series production within the next five years or so.” Sievers emphasized that the BlueBox already has automotive-grade silicon, which is not always the case when carmakers and technology companies demonstrate highly automated driving – with a trunk full of non-automotive-grade prototype computers.

Not the implementation of a prototype computing platform is the real challenge, Sievers pointed out, but turning such a platform into series-ready, automotive-grade car computers. “At present, we do not have enough computing power to realize a level 4 or level 5 vehicle at an economically viable scale – and I would like to emphasize that this holds true for the rest of the industry as well”, Sievers remarked.

Like Reger, Sievers called to drive more attention to the sensing technology. According to the NXP manager, computing platforms are much more in the limelight of the media than sensors, which however creates a misleading picture. “I think that the technological challenges in the area of sensing are widely underestimated today. With better sensors, it would be possible to achieve good results with less computing power”, he said.

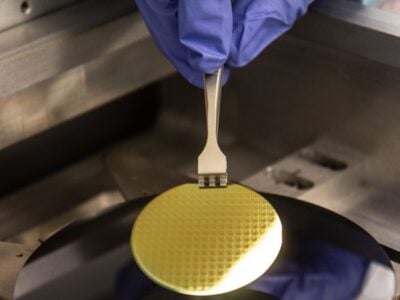

Sievers also expects that Qualcomm will help resolving the compute power bottleneck by contributing its highly performant technologies. Qualcomms current lead is based in part on its superior semiconductor technology; the company is already working with smaller silicon geometries – albeit not with automotive-grade silicon. “Nobody has this,” Sievers said. “This is a huge challenge. You cannot simply take a smartphone or PC chip and make it automotive-ready. There is a whole range of physical limitations that are not easy to overcome. NXP has the technology to solve today’s problems; it however would probably be difficult to solve the problems of tomorrow and the day after tomorrow with this technology. This will get significantly easier with Qualcomm.”

The absolute buzzword in autonomous driving is currently Artificial Intelligence; an increasing number of players is entering the market. The company emerging from the NXP-Qualcomm merger will also be involved in this area, Sievers said. At the same time, he warned not to overhype AI: “I am not convinced that the solutions we eventually will see in mass production will need to be AI systems,” he said. The reason: There are scenarios to teach the system at prototype level while the series vehicle will run with the learned algorithms. Such an allocation would lead to more cost-effective solutions.

The combined market coverage of NXP and Qualcomm. (Source: NXP)

Reger added that the most likely solution will embrace both neural networks (a variety of AI) and conventional programming. “Carmakers currently working intensively with neural networks”, Reger said. “These are non-deterministic systems. In the case of an accident, it could be difficult to comprehend how such a system came to its decisions. Thus, it is possible that we will see neural networks and normal deterministic detection algorithms in parallel. AI is necessary, but not in all cases sufficient,” he elaborated.

In the light of statistics showing that show that today most innovations in the automotive industry come from the semiconductor and the software industry, it seems likely that the working relationship between semiconductor vendors and automotive OEMs is changing. Definitively yes, Sievers said. “Clearly, a large part – not everything – of automotive innovation is driven now by electronics, and of course in electronics, semiconductors call the tune.” He however pointed out that software is equally important. And therefore, it is necessary that chipmakers have a very tight collaboration with the software industry. The relationship between chipmakers and carmakers is currently becoming more intensive, Sievers acknowledged. “You read the announcements that OEMs are entering strategic collaborations with semiconductor providers. It is no coincidence that we see this happen now. It is the result of the innovation power of the semiconductor industry,” he said.

Nevertheless, he continued, it is important to understand that the car is – and will remain – a mechanical being in the first place, “with wheels and suspension and steering and thus subject to the physics of driving.” Nevertheless, the innovation process in the automotive industry is somewhat tilting towards the side of electronics. Therefore, the semiconductor industry is getting a different weight. “We observe that many OEMs throughout the world actively engaging with semiconductor manufacturers – they seek a tighter relationship with us. For us this is good, because we get much better insights into the necessities and challenges of car building.”

Related articles:

Software-defined car takes shape

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News