“Open systems have stronger assertiveness than closed ones”

eeNews Europe: Automotive software is currently going through an extraordinarily dynamic phase, both in terms of technology and market development – keyword software-defined car. Where will you steer Elektrobit?

Maria Anhalt: About ten years ago, software accounted for about 10% of the value of a car. By 2030, this share is expected to rise to 30 % or more – assuming an all-electric vehicle. It is not just the amount of software and its complexity that is increasing – no, the value of vehicles is being determined to an ever-greater extent by software. So, we’re seeing two vectors at the moment: one is the technology and the dependence on the software, the software is becoming an integral part of the car. And secondly, there is the business dimension, the business model. Here, too, software is playing an increasingly important role. The same applies to the value chain. In addition, it determines the entire life cycle of a car: we are talking about services and completely new products on the market that are created through the use of software.

Elektrobit has been involved in automotive software for many years and has deep roots in the integration business. This has given us a strong reputation with customers. Today, we are quite broad with our product portfolio. We have four main areas of focus: Infrastructure software, i.e. everything that is software infrastructure in a car, then connectivity and security, then the topic block of autonomous driving, and finally user experience. We are represented with our own products in all four of these areas. As a unique selling point, we also offer consulting and services, which our competitors do not necessarily offer. Either they offer products and work with other companies to integrate those products, or they focus on the integration business and look at where they source their products from. We want to expand that even more by offering integrated solutions. We want to focus specifically on high-performance computing platforms – a very important development at the moment. At the end of last year, we launched an integrated suite called EB xelor, an integrated solution with which we are the first provider on the market. It is an integrated suite that offers solutions for in-car (computing) platforms. It contains a hypervisor, a Linux operating system, an Autosar layer. It is all pre-integrated, tested, customized, and can be adapted for an OEM.

eeNews Europe: Where do you see Elektrobit going from here, both technically and in terms of business?

Anhalt: Our strategy is more focused on becoming a strong partner for systems and subsystems for automotive manufacturers, and we offer the full range of products as well as services for differentiating and non-differentiating software. To stay ahead in the fast-paced technological change, we will look much more at where our competitive advantage is and where we can partner with other companies. This applies, for example, to the IT sector, where I come from. One example: instead of developing our own Linux derivative, last year we entered into a partnership with SUSE, one of the big Linux distributors. In this partnership we were able to offer a very mature solution much faster than our competitors.

Another development is that we are also working with the high-tech giants, i.e. companies such as Microsoft or Amazon. This enables cloud connectivity “out of the box” instead of developing it ourselves. We want to put that together with our deep automotive expertise to bring reliable, secure software to the market for the automotive industry.

eeNews Europe: Various OEMs such as Daimler, BMW, or Volkswagen are not only massively expanding their own software expertise but are even developing their own operating systems. What is left for companies like Elektrobit? Does that narrow your scope – or does it possibly even open up new business opportunities?

Anhalt: It’s very good for us because it shows how interested these companies are in software. For years, we have been working with the OEMs you mentioned in the area of operating systems. For example, we developed the first standard core together with BMW around the year 2000, which was an OSEK-based operating system. This software ran – and still runs – in quite a few million cars. We are one of the largest suppliers of Autosar software, a very important layer in the operating-system software for cars: every third car worldwide runs with Autosar, in Europe even every second car. This means that millions of cars already have this essential system software installed. We continue to work with OEMs at the operating system level.

If you look at the automotive OS in terms of technology and architecture, you see that it has several layers. It is a very comprehensive software: hardware, hypervisor, operating system – whether Linux or embedded like QNX or similar – on top of that, Autosar, middleware, followed by other layers that are mostly OEM-specific. Only then come the algorithms that directly define the functions. Overall, about 60% of the software in a car is non-differentiating, only 40% is differentiating. It follows from this: A large part of the software is non-differentiating for the end user and also for the car manufacturer. On the basis of this software, it is impossible to distinguish whether you are sitting in a BMW, a VW, or a Ford, for example.

Of course, a large part of the software is also very important for the brand. The OEMs focus their development on the differentiating parts. They are looking for reliable partners who can implement the non-differentiating software quickly, safely, and efficiently. That way they can get the costs under control. This is our sweet spot. Of course, we also develop differentiating software if required by a customer. So, we also regard the car industry’s efforts to develop their own operating systems as a business opportunity for us. That’s why we have the EB xelor product line I mentioned – that’s exactly the non-differentiating part. If we deliver pre-integrated software, an OEM can save up to 30% of the costs because it is pre-integrated and customized and the OEM only has to configure it.

eeNews Europe: software reuse as a cost brake?

Anhalt: Correct. Standardization, modularization, open systems, interfaces. We also offer software developer kits (SDKs). With these, we give our customers a development environment with the help of which they can adapt many things automatically. This offers enormous possibilities and is much less common in the automotive industry today compared to the high-tech industry with its data centers.

eeNews Europe: What role do chip-level architectures play for HPC platforms? I suspect that one role of non-differentiating software could be to keep this hardware as interchangeable as possible – giving the OEM freedom of choice. Right?

Anhalt: The value of the software increases if it is hardware-agnostic, i.e. if the software is open and can be adapted to many different requirements. If you develop the software to work “out of the box” with as many hardware manufacturers as possible, there is a huge economic benefit.

By the way, the hardware manufacturers are just as interested. We are also in partnership talks with some of the silicon manufacturers with the goal of offering immediately executable integrated solutions. The interest is mutual.

eeNews Europe: In the future, OEMs will be obliged to provide cybersecurity for the entire life cycle of vehicles. Does that open up new business opportunities for you?

Anhalt: Yes, but this is not new per se, because we have been working with OEMs in this field for years. For example, we are working with one of the largest car manufacturers in the field of embedded security to bring secure and safe function updates to the workshop. The next step will be updates over the air.

eeNews Europe: Does the market constellation allow a company like yours to operate cybersecurity centers on behalf of OEMs?

Anhalt: We can do that, yes.

eeNews Europe: That doesn’t sound as if it would be immediately obvious?

Anhalt: So far, no OEM has approached us with this. What the OEMs need are turnkey procedures for OTA updates, something they can do automatically. The technology has to be such that you can do updates automatically over the whole life cycle of about 15 years. But that doesn’t just apply to security, it has to be feasible for all kinds of things in the car. Therefore, it is not only a question of the security component, but of fundamental importance for the software: How can you establish a maintenance, a support business that works seamlessly, even when the car is already rolling on the road? The question is much more extensive and complex than simply operating a security center. Of particular importance for OEMs is the question of who they work with to ensure that the car is not hacked. Such an intrusion would be the Maximum Hypothethical Accident.

eeNews Europe: In commercial IT, where you come from, a few operating systems have prevailed; there used to be many more. Is a similar shakeout on the horizon for the automotive sector?

Anhalt: I wouldn’t say it’s on the horizon yet, but it could be on the way. None of us has a crystal ball in which to read the future. But if you look at the development in corporate IT or even smartphones, you see that the technologies that have always prevailed are those that not only had good innovative concepts but have actually proven themselves in practice. Open, agile systems typically have stronger assertiveness than closed systems. Innovation is hugely important for competitive advantage, but the ability to put something into practice quickly and productively is even more important.

eeNews Europe: When it comes to operating systems, are there any candidates that you think could establish themselves as the standard in the vehicle market? Like Android for smartphones?

Anhalt: No, such a standard is not in sight. Our attitude is that open systems and the ability to implement them are the decisive factors.

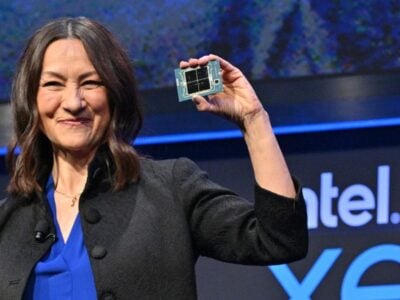

Maria Anhalt has been promoted from CTO to CEO at Elektrobit Automotive GmbH since the beginning of the year. Previously, she held the position of Vice President at Continental’s Cross Divisional Systems and Technology department. Earlier in her career, she worked for Hewlett Packard Enterprise and Micro Focus, focusing on business development and R&D management in the areas of hybrid cloud and automation software. Anhalt is from Bulgaria and studied electrical engineering at Sofia University – where, Anhalt says, “it’s quite normal for women not only to study e-engineering, but to be professors of it.” She perfected her academic career at Harvard and Stanford.

www.elektrobit.com

Related articles

Volkswagen unveils plans for next gen electric car, digital future

German automotive industry creates sector-spanning digital platform

Bosch taps Microsoft for automotive cloud platform

Continental announces cyber-security solution for connected cars

Continental subsidiary launches HPC software platform for vehicles

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News